Buying a home is often described as the single largest purchase most people will ever make. While the listing price is the first figure buyers look at, the truth is that the price tag only tells part of the story. To make a sound financial decision, you must understand the true cost of homeownership—which goes well beyond the mortgage payment.

In this guide, we’ll break down the hidden and ongoing expenses that can make a big difference in your budget and long-term financial health.

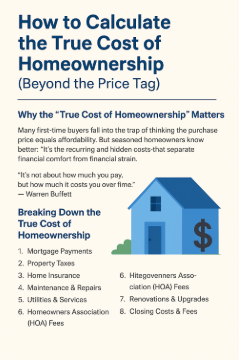

Why the “True Cost of Homeownership” Matters

Many first-time buyers fall into the trap of thinking the purchase price equals affordability. But seasoned homeowners know better: it’s the recurring and hidden costs that separate financial comfort from financial strain.

As Warren Buffett once said:

“It’s not about how much you pay, but how much it costs you over time.”

Ignoring these factors can lead to being “house poor”—owning a beautiful home but struggling to cover day-to-day living expenses.

Breaking Down the True Cost of Homeownership

1. Mortgage Payments

This is your base cost and usually the largest. Your monthly mortgage depends on:

-

Loan amount

-

Interest rate

-

Loan term

-

Down payment

But remember, the mortgage is only one piece of the puzzle.

2. Property Taxes

Property taxes vary by location but can add thousands of dollars to your annual expenses. Be sure to:

-

Check the local tax rate before buying.

-

Factor in the likelihood of future increases as neighborhoods develop.

3. Home Insurance

Standard homeowners’ insurance covers damage from events like fire, theft, and some natural disasters. Costs can differ based on:

-

Size and age of the home

-

Location (flood zones, hurricane-prone areas, etc.)

-

Coverage level and deductibles

4. Maintenance & Repairs

Industry experts recommend budgeting 1–3% of your home’s value annually for upkeep. That means if your home is worth $300,000, you should set aside at least $3,000 to $9,000 each year for:

-

Roof repairs

-

Plumbing issues

-

HVAC servicing

-

Landscaping

5. Utilities & Services

Beyond water and electricity, homeownership often includes expenses renters don’t face, such as:

-

Trash collection

-

Sewer fees

-

Internet/cable installation

-

Lawn care or pest control services

6. Homeowners Association (HOA) Fees

If your property is part of a community with an HOA, expect monthly or annual dues. These can range from $50 to $500+ depending on amenities like pools, gyms, and landscaping.

7. Renovations & Upgrades

Over time, most homeowners want to personalize or modernize their space. Whether it’s remodeling the kitchen or upgrading windows, these projects carry substantial costs that aren’t reflected in the original price tag.

8. Closing Costs & Fees

At the time of purchase, don’t overlook expenses like:

-

Loan origination fees

-

Appraisals

-

Title insurance

-

Legal fees

These can add up to 2–5% of the home’s purchase price.

How to Estimate Your True Cost of Homeownership

Here’s a simple formula to guide you:

Monthly Mortgage + Property Taxes + Insurance + HOA Fees + Average Maintenance + Utilities = True Monthly Cost

By running the numbers in advance, you’ll avoid financial surprises and determine if the home truly fits your budget.

Final Thoughts

Understanding the true cost of homeownership ensures you’re not just buying a house—you’re securing a lifestyle you can comfortably afford. Beyond the price tag lies the reality of ongoing responsibility, and smart buyers prepare for it.

As the saying goes:

“You don’t just buy a home. You buy into everything it takes to keep it standing.”

Before you make your next move, take the time to calculate the real costs—your financial future depends on it.

Leave a Reply