Real estate investors today face a crucial decision: should you focus on short-term rentals (like Airbnb or vacation homes) or stick with the stability of long-term rentals? Both strategies can generate income—but they come with very different risks, rewards, and responsibilities.

To decide which is right for you, you need to look beyond trends and understand how each model works in today’s ever-changing housing market.

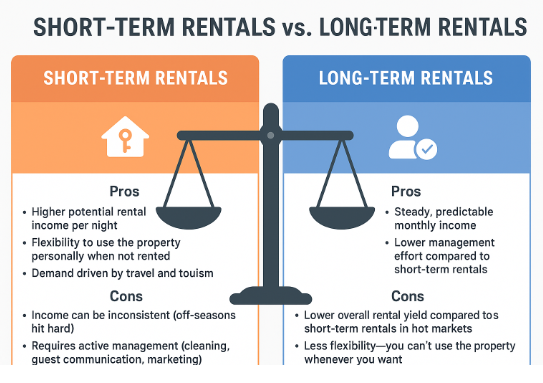

Short-Term Rentals Explained

Short-term rentals are properties leased for days or weeks at a time, usually through platforms like Airbnb, Vrbo, or Booking.com. They’re popular in tourist-heavy cities, business hubs, or seasonal vacation spots.

Pros:

-

Higher potential rental income per night.

-

Flexibility to use the property personally when not rented.

-

Demand driven by travel and tourism.

Cons:

-

Income can be inconsistent (off-seasons hit hard).

-

Requires active management (cleaning, guest communication, marketing).

-

Local laws and regulations are becoming stricter in many cities.

Long-Term Rentals Explained

Long-term rentals typically involve tenants signing leases for 6–12 months or more. These are the classic “buy and rent” properties many investors rely on.

Pros:

-

Steady, predictable monthly income.

-

Lower management effort compared to short-term rentals.

-

Tenant usually covers utilities, reducing expenses.

Cons:

-

Lower overall rental yield compared to short-term rentals in hot markets.

-

Less flexibility—you can’t use the property whenever you want.

-

Bad tenants can create long-term problems.

Short-Term Rentals vs. Long-Term Rentals: Which Performs Better Today?

The answer depends on market conditions, location, and investor goals.

-

Tourism-driven markets (beach towns, urban hotspots, cultural hubs): Short-term rentals often outperform with higher income potential.

-

Stable residential markets (suburbs, college towns, commuter areas): Long-term rentals shine with reliability and lower vacancy rates.

-

Today’s trends (2025):

-

Rising travel demand post-pandemic has boosted short-term rental profitability.

-

At the same time, stricter city regulations and higher management costs make long-term rentals safer in many regions.

-

👉 Smart investors often combine both strategies by diversifying their portfolio.

How to Choose the Right Strategy

Ask yourself:

-

What’s my risk tolerance? Can I handle fluctuating income or do I need consistency?

-

Do I want to be hands-on? Short-term rentals require more work—or the cost of a property manager.

-

Where is the property located? Tourist destinations favor short-term, while residential neighborhoods favor long-term.

-

What are local regulations? Some cities heavily restrict or ban short-term rentals.

Final Thoughts

When comparing short-term rentals vs. long-term rentals, there is no one-size-fits-all answer. The right choice depends on your goals:

-

If you want higher returns and can handle the work (or hire help), short-term rentals might be the way to go.

-

If you prefer stability, lower risk, and predictable income, long-term rentals are hard to beat.

As real estate wisdom goes:

“The best investment strategy is the one that matches your lifestyle as much as your wallet.”

Leave a Reply